Is It Time For A 1031 Exchange?

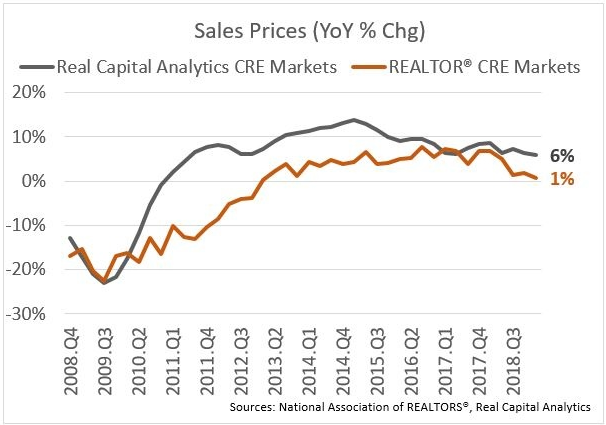

Are we still seeing the tremendous rise in real estate values, especially commercial properties? Yes, the values are definitely still rising, just not as fast as the last few years. But, with all of this upward movement and list prices surpassing the “bubble levels,” the property you own may be ripe for a 1031 Tax Exchange.

The 1031 exchange is one of the most powerful tools for any real estate investor to build wealth. That’s because this tax program allows you to sell your current investment property and use the proceeds of the sale to invest in more properties without paying a capital gains tax.

What is a 1031 exchange?

Under Section 1031 of the United States Internal Revenue Code, a taxpayer may defer payment of capital gains and related federal income tax liability on the exchange of like-kind real property held for productive use in a trade or business or for investment. This process is called a 1031 exchange. Today, only real property is included under Section 1031.

“On the West Coast, it’s almost commonplace. If it’s an investment property or business-use property, boom, escrows contact a qualified intermediary and say OK, run with this. On the East Coast, it’s very different because a lot of people don’t know about 1031 and often find out about it a few days, a couple weeks before closing. It’s a different dynamic on the East Coast.” – 1031 Corp. President Margo McDonnell

What are the benefits of a 1031 exchange?

Tax Benefits

The brilliance of this strategy is that it allows an investor to build wealth for themselves and their family by deferring a capital gains tax. If they leave their investment portfolio to their children who decide they don’t want to be in the real estate investing game, they can sell the property, BUT they will only have to pay taxes on the profit of the very first 1031 exchange.

Grow your portfolio

This is a great way for real estate investors to parlay one income-producing property into several rental properties. Using the profit from the sale of the previous property, investors can diversify and grow their portfolio. They can increase their net worth tax-free!

Offload underperforming assets

An investor with an underperforming portfolio can use a 1031 exchange to buy properties with a higher value or better monthly cash flow. If the investor currently has a property that is sitting unoccupied or has low margins, this a great opportunity to target other properties of the same or greater price that have better cash flow potential.

It’s repeatable

There are limitations on when you can sell a property using a 1031 exchange, but there is no restriction on how many times an investor can utilize it in their lifetime. This is a long-term and repeatable strategy to build massive wealth and avoid capital gains taxes. This is how the rich make their money.

Minimize taxes for your beneficiaries

This strategy allows investors to pass down their properties and profits to their children or beneficiaries without paying any taxes on the gains. A “stepped-basis” is applied to the property upon death, which is the readjustment of the value of an appreciated asset at the current fair market value. When the property is passed on to an heir, its value will typically be more than when it was acquired by the investor. Capital gains tax is minimized for heirs because the property is evaluated based on the value and not the built-in gain attributable to the taxpayer. The deferred capital gains taxes won’t be transferred to the beneficiaries.

Using a 1031 exchange allows people to build a legacy of long-term wealth for their family while minimizing the amount of taxes paid.

What are the basic rules of a 1031 exchange?

There is a lot involved in this process, but here are some basic rules that investors need to know:

- The property must be an investment property (not lived in by the owner).

- The property must be owned for at least a year and a day (so flips are not qualified).

- Investors have 45 days within the close period to identify the new properties they will buy.

- The investor’s list should have three properties or less. If they want to buy more than three, the investor will be subjected to the 200% rule. The total combined purchased price of everything on the list can’t be more than twice the selling price of the original property.

- Investors have 180 days to close on the new properties from the sale of the first property. So, title and closing agents need to be aware of these deadlines to ensure they can meet them.

- Investors need an independent third party to hold the money in escrow called a Qualified Intermediary (QI).

- How the investor held title on the old property is how they have to hold the title for the new property.

- All cash gained from the sale must be used for another investment property. Investors must buy equal or more in price and must reinvest all of the proceeds. They can’t pocket some of the money from the sale.

- There’s no requirement that the debt on the new purchase must be equal or more than the debt on the old property.

- Closing agents will need to make some minor changes to the Closing Statement to reflect the exchange, but the transaction is handled like a typical closing. The Qualified Intermediary will provide more instructions before closing.

You need a trustworthy Qualified Intermediary

An investor can appoint any individual or company to be their Qualified Intermediary (QI). Ideally, they will want to choose a trustworthy professional with experience in real estate closings, but they can choose almost anyone. Exclusions include related parties, agents of the taxpayer, like a CPA, accountant or attorney, employees of the taxpayer, and your real estate agent. Anyone who has acted within any of these professional capacities for the taxpayer within the past two years is barred from acting as the QI. Essentially, the QI must be an independent third party with no prior association with the taxpayer conducting the exchange.

The Qualified Intermediary assumes the role of a middleman in the exchange. Some of their duties are:

- Control the exchange proceeds

- Prepare all of the necessary exchange documents

- Acquire and convey properties through a paper assignment

- Coordinate the details with the closing agents

- Remind the parties involved in the closing of the strict deadlines

You should choose wisely since the lack of strict regulations on persons acting as QI’s can get you in trouble with the wrong choice. People involved with a company called LandAmerica 1031 Exchange Services, Inc. found that out the hard way when the company declared bankruptcy. The agreements they used lead the court to treat the exchange funds as debts instead of a trustee/beneficiary arrangement.